The Covid-19 pandemic is likely to lead to the largest economic collapse since the Great Depression. The EU has gone to work on a recovery programme and asked its member states to adopt their own national plans. Given the magnitude of the imminent economic crisis, recovery programmes will be supported by government financial stimuli surpassing those deployed against the financial crisis in 2008. Anna Skowron and Stefan Schurig assess the green credentials of EU and German recovery packages and where opportunities to secure a sustainable energy transition lie.

With advancing climate change and increasing extreme weather events, crises of global scale are likely to occur more frequently in the future. Any recovery packages responding to the current pandemic therefore need to take a strong stance for green, low-carbon development and try to mitigate the worst impacts of climate change. Hence, stimuli without an unconditional commitment to high shares of renewable energy cannot be considered recovery packages. At the same time, this gives us the opportunity to fast-track Europe’s energy transition with renewable energy as the backbone for inclusive, green growth.

Two of the most significant recovery packages – those of the EU and Germany – seem promising, with multi-billion-euro figures earmarked for energy and climate action, drawing on the policies of the European Green Deal. Yet closer inspection reveals many of the plans for this funding are not as sustainable as they could be, and much remains conditional and uncertain. Thus, there is a serious risk of a greenwashed recovery, unless governments are held to account and legislators insist on real change.

The role of legislators

Parliamentarians in Europe play a crucial role in this transformation. Recently, members of the environment committee of the European Parliament (EP) reached an unprecedented consensus that Europe’s climate law should aim for a 60 per cent reduction of CO2 emissions by 2030, while the EU Commission proposed a 55 per cent reduction the same year.

Legislators also play a central role by adopting national budgets and laws, and overseeing the decisions of their governments. This is of major relevance when considering trade-offs between economic recovery and the climate crisis. In times of crises, the Executive may ask parliament to grant it additional powers, in order to carry out measures deemed essential to react quickly and mitigate impacts, such as closing borders or restricting freedom of assembly. Even at such times, parliaments provide “necessary checks and balances to guard against the excesses of the Executive”. In the current health crisis, this has meant the prioritisation of health legislation followed by economic responses.

Budget legislation is a parliament’s strongest means of controlling the government.

Budget legislation is a parliament’s strongest means of controlling the government. The EP shares the power to decide on the entire annual budget of the EU with the Council of the European Union. This gives the EP significant power over a truly green recovery. To limit the financial burden on Europe’s taxpayers, the EP is proposing new revenue streams to finance the costs of recovery instruments, such as income from the Emission Trading Scheme (ETS) and a carbon border tax. Both measures could potentially become a win-win situation, if implemented correctly, as they would reduce the financial burden, greenhouse gas emissions, and implement a level-playing field for renewable energy.

Learning from the past: the financial crisis 2008

A close look at the recovery packages mobilised to mitigate the 2008 financial crisis is crucial if we want to avoid repeating mistakes of the past. Around 10 trillion US dollars were pumped into global economies that year, with western European countries paying more than a third of this total. To put this into perspective, this was about “30 times larger than today’s value of the Marshall Plan”. This time, recovery packages will likely be larger: the EU’s recovery tool Next Generation EU is worth 750 billion euros, and Germany’s national recovery strategy accounts for 130 billion euros.

Many stimuli packages – most notably those of Germany, the EU, the US, China, Japan and South Korea – following the financial crisis of 2008 were labelled “green”. According to estimates of the International Energy Agency (IEA), green aspects of recovery comprised between 10 and 20 per cent of the total. Macroeconomic benefits are further estimated to have ranged between 0.1 per cent and 0.5 per cent of global GDP for the two years following the financial crisis. Yet, from an emissions point of view, they are anything but that. After declining by 400 million tonnes in 2009 in the aftermath of the economic downturn, global emissions rebounded by 1.7 billion tonnes in 2010, according to the IEA. This surge was mostly driven by rapidly developing countries in Asia. Nevertheless, the crisis led to significant energy efficiency improvements globally and the recovery packages provide insights into which strategies worked well and which did not.

After declining by 400 million tonnes in 2009 in the aftermath of the economic downturn, global emissions rebounded by 1.7 billion tonnes in 2010 […]

Most packages focused on scalable and modular technologies by increasing their already allocated budgets. Investments into previously smaller-scale solar and wind power applications were scaled up. The economic stimulus triggered a cost decline in these technologies which led to further investments. In contrast, financial support for larger-scale projects with relatively immature technologies performed poorly in comparison. In most cases, research and subsequent deployment were not fast enough to generate a demand strong enough to trigger further investments. Nevertheless, the IEA contends that economic gains through renewables deployment and energy efficiency enhancements contributed positively to economic recovery after the financial crisis.

The European Union’s answer to the crisis

At first glance, the EU seems to have learned from the last crisis: many policies included in strategies can be traced back to the European Green Deal adopted in late 2019, to stimulate private investment and create jobs across the EU.

Overall, a budget of 750 billion euros will be available to member states under the Next Generation EU. And that is in addition to the overhauled multi-annual EU budget of 1.1 trillion euros, following a call from MEPs for a major recovery package in April. Around 25 per cent of this will be earmarked for climate-friendly investments.[1] Whether the remaining three quarters will also benefit climate action, energy efficiency and renewable energy, is yet to be determined. To access around 500 billion euros in grants and a further 250 billion euros in loans, member states are requested to set up National Recovery Plans in compliance with the EU’s reform programmes, the National Energy and Climate Plans (NECPs), and just transition plans.

Most of the EU money will be invested to achieve three strategic pillars: support member states to recover, repair and emerge stronger from the crisis; boost private investments and support ailing companies; reinforce key EU programmes to accelerate the twin green and digital transformation.

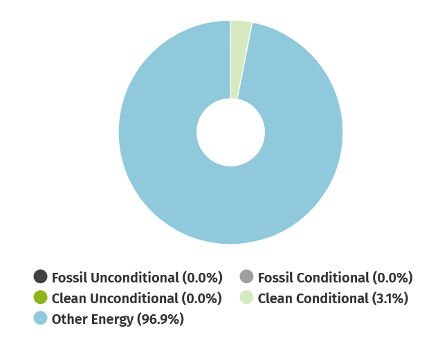

Many of the planned actions could potentially benefit climate change mitigation and renewable energy deployment but are not yet quantified in official legislation, according to Energy Policy Tracker. Furthermore, only around 326.7 million euros have been committed to clean energy, most of it conditional.[2] Most of the currently quantified budgets for energy (around 11 billion euros) can neither be allocated to clean nor fossil energy sources. It remains to be seen what the future holds for the pivotal role renewable energy should be playing in the EU’s green recovery efforts.

Given that much of the recovery fund is based on measures stipulated in the European Green Deal, the share of climate-friendly investments will likely exceed the 326.7 million euros already committed. Renewable energy and energy efficiency enhancements could play a key role in recovery efforts. In addition, accelerated deployment of offshore wind is seen as a crucial component of the Green Deal. Further, innovation to kick-start Europe’s hydrogen trajectory, e-mobility, batteries, carbon capture and storage, and energy efficiency improvements are mentioned as strategic pillars. Those plans will be complemented by a new Action Plan on Raw Materials which seeks to strengthen crucial markets needed for rapid renewable energy deployment and e-mobility. As well as a sustainable finance taxonomy which will guide spending the recovery funds. In theory, the “do no harm” principle underlying the taxonomy would exclude fossil fuels and nuclear energy, “which are seen to be undermining other environmental objectives such as pollution prevention and control,” according to Euractiv. And indeed, the recommendations exclude solid fossil fuels. Yet, the taxonomy leaves the door open for natural gas (liquid natural gas for example) to be included. Similarly, the EP voted to allow natural gas to be included in projects financed by the Just Transition Fund.

Most of the currently quantified budgets for energy […] can neither be allocated to clean nor fossil energy sources.

In light of the recent announcement to enhance climate ambition and cut greenhouse gas emissions by 55 per cent by 2030, some of these policies will need to be re-assessed; a 55 per cent emissions reduction requires cutting back on fossil fuels rapidly and ramping up renewables. In September, the European Parliament’s Environment Committee even agreed to reduce greenhouse gas emissions by 60 per cent compared to 1990 levels.

Germany’s recovery package

To strengthen Germany’s economy, the federal government adopted a 130-billion-euros stimulus package in June 2020 which was passed by the parliament earlier in March. The largest share will be invested into strategic pillars: economic recovery of municipalities, economic growth for industries, climate mitigation, e-mobility, education, research and innovation, and digitalisation. Around 26.6 billion euros have been allocated for energy and climate action, making it a key objective – at least on paper. Some of the measures for renewable energy deployment and e-mobility include a cost reduction of consumer electricity bills by cross-financing the guaranteed feed-in tariff and removing a cap on photovoltaic deployment which was originally established to protect the German coal industry and to artificially slow down solar electricity generation in Germany. A plan to increase acceptance of wind energy through a profit scheme for municipalities is now on the table, as well as financial benefits for e-vehicle purchases, and charging infrastructure and energy improvements.

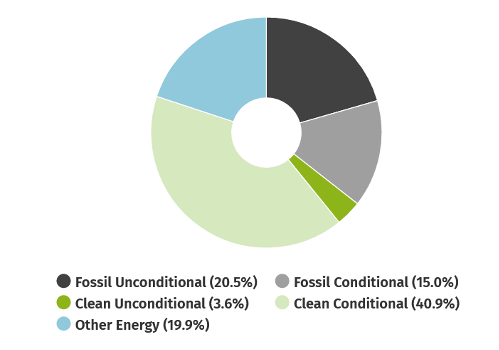

Despite looking promising and progressing in the right direction, a closer look at Germany’s recovery package reveals weaknesses. While substantial funds are channelled towards clean energy and climate action, most of it remains conditional. According to the energy policy tracker, only 1.8 billion euros of investments can currently be considered truly “green” and “clean”. A further 21 billion euros depends on various conditions such as the implementation of environmental safeguards, or ensuring e-vehicles are powered by renewable electricity rather than fossil-fuel-based electricity. Therefore, the stimuli currently considered “green” may not turn out to be so green after all, if conditions are not met, which could be described as green-washing. In stark contrast, unconditional investments for fossil fuels amount to a staggering 10.5 billion euros, for the unconditional bailouts of Lufthansa, Condor and TUI airlines.

Apart from the spending, it is crucial to also have a closer look at the measures themselves. With increased e-mobility and green hydrogen production, Germany’s energy demand is likely to grow to a level which the current expansion plans for renewable energy cannot satisfy, nor are they enough to achieve the 65 per cent renewable energy target. This concern is intensified by the option for states to implement a rule requiring a minimum distance of 1000 metres between wind projects and settlements or housing areas. Expansion of onshore wind power would be put on hold as a result. If concerns hold true, stimulus measures to promote e-vehicles in Germany will not be fed by renewable energy, but rather fossil-fuel-based electricity. Further, no clear targets have been set regarding whether “green” or “blue”[3] hydrogen will be produced, and to which extent hydrogen will be imported and environmental safeguards implemented.

Further, cross-financing the renewable energy surcharge through income from the ETS scheme rather than being financed as a surcharge on energy consumption would indeed reduce the burden on end-users in the short run. But it might lead to problems in the longer term if cross-financing is removed as part of reducing public spending and the national debt in the wake of the corona crisis. Rather than a surcharge, it is needed to provide a level playing field for renewables in the context of highly subsidised fossil fuels.

Although Germany’s recovery package makes climate and clean energy one of its strategic priorities, at least on paper, the conditions have to be met to ensure e-mobility remains “green” and “clean”. Therefore, accelerated deployment of large-scale renewable energy as well as stronger empowerment of prosumers is needed. Yet, this has so far been lacking from any recovery measures. Unless actions follow, the recovery package is a mere lip service to appeal to increasingly environmentally conscious voters.

Enhancing cross-party collaboration

We are at a crossroad: will the current paradigm of economic growth prevail, or will we shift towards more sustainable, clean-energy-based forms of economic activity? Stronger cross-party cooperation is needed if we want to build back better in the post-Covid-19 era and tackle global crises. While some members of national and European parliaments are part of a progressive movement calling for strong action on renewables, awareness of the manifold socio-economic benefits of renewables is often sorely lacking. For example, few people are aware of the fact that more people found decent jobs in Germany’s renewable energy sector than in the coal and nuclear energy sector combined.

Parliaments have a crucial role to play in accelerating sustainable development and the energy transition, as well as ensuring no one is left behind. Parliamentary networks focused on scaling up renewables such as EUFORES in Europe or the Global Renewables Congress (GRC) (which connects legislators from around the world) are a crucial part of this effort. Parliaments must also find innovative ways of working and providing important checks and balances at a time when physical meetings are difficult or impossible.

The EP’s strong stance could be an indicator of the political will for sustainable development and green recovery.

Likewise, MEPs and MPs will have to fight for their right of oversight over budgets and shaping recovery packages. The EP, for instance, published a position in late July outlining their desire to be fully involved in all decisions on recovery packages. This would not only enable them to make sure stimulus packages are being allocated without reducing existing budgets, but also to ensure the needs of the countries they represent are met accordingly. The EP’s strong stance could be an indicator of the political will for sustainable development and green recovery. With budget discussions still ongoing and the role of MEPs in recovery packages yet to be determined, time will tell if this holds true or not.

[1] No clear indication is given about the definition of “climate-friendly investments”. From previous statements however it can be concluded, that the “do no harm” principle of the sustainable finance taxonomy which guides investments, will exclude most fossil fuels and nuclear energy. In addition, energy, research & innovation and SDG policies will play a crucial role in spending. (See: Euractiv)

[2] This article uses the definition of the energy policy tracker for both “clean conditional” and “clean unconditional” investments. According to which “clean conditional” refers to potentially clean investments, “stated to support the transition away from fossil fuels, but unspecific about the implementation of appropriate environmental safeguards.” “Clean unconditional” in contrast, mention specifically environmental safeguards.

[3] “green” hydrogen is typically referred to as hydrogen produced with renewable energy, while “blue” hydrogen is produced using natural gas and typically captures and stores carbon emissions.